+91 911 0690 470, +91 989 5730 470

+91 911 0690 470, +91 989 5730 470

Life Insurance

Two risks which are addressed by the life Insurance companies are, Dying early and living too long.

1 Dying early : This risk can be addressed by buying a term plan, it would help in financial backup for the dependent family members.

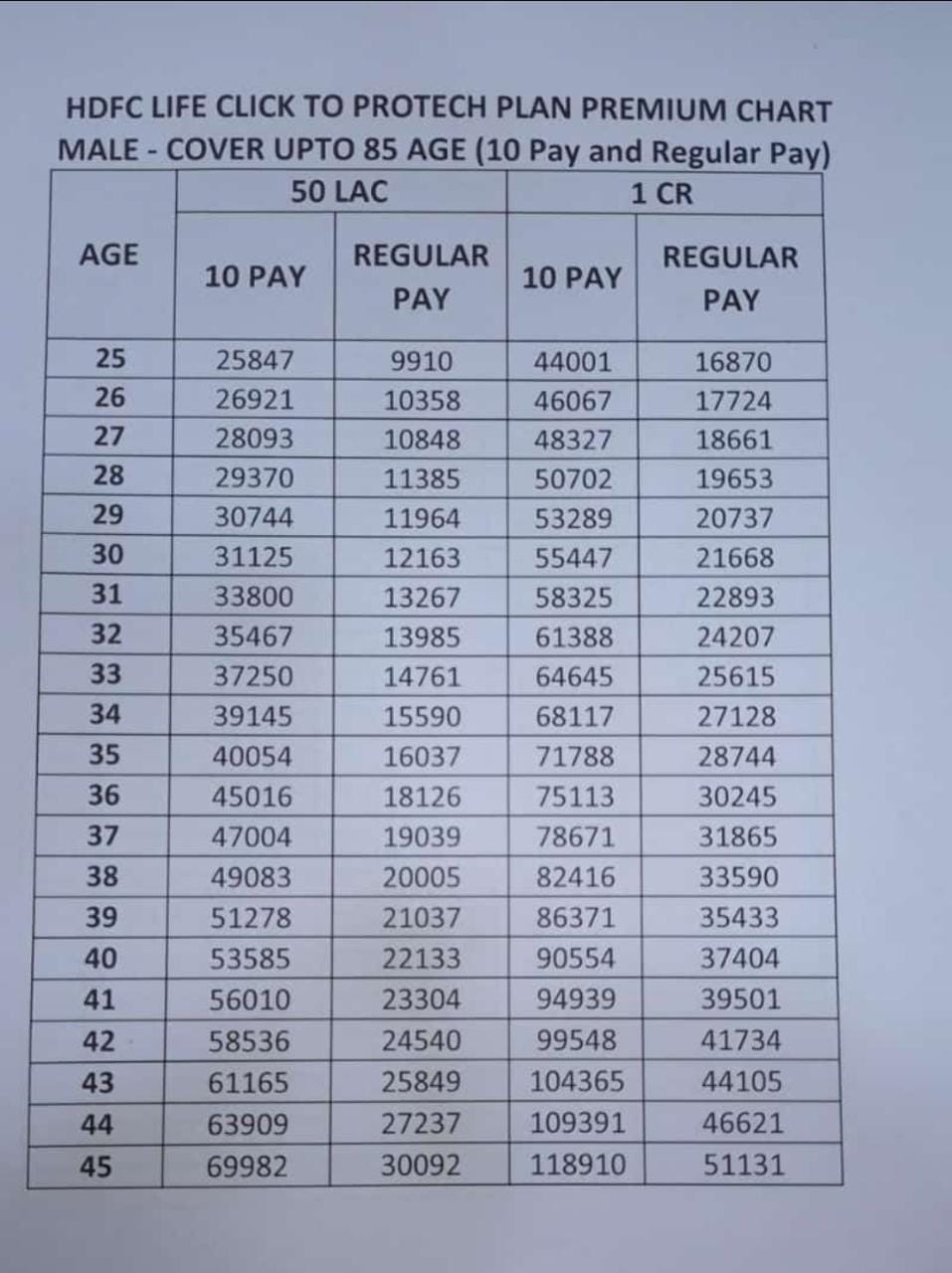

HDFC offers 2 options

- Regular premium payment till Age 85

- Limited premium payment for 10 yrs

Term Plan Chart

2 Living long : This risk can be addressed by buying a money back plan.

HDFC sanchay plus has one the best plan to address long term cash flow option.

Generate illustration Download BrochureExample : Invest Rs 1,00,000 for 12 years, cooling period 1 year, their after from 14th year onwards you receive Guaranteed, tax free (under Sec 10 10(D)) and fixed amount of Rs 1,46,750 for 30 years and Rs 12,00,000 upon maturity.

Total investment : Rs 12,00,000

Total payout : Rs 56,02,500

USP of HDFC Sanchay plus

- Insurance is till premium payment period, so less cost on insurance

- Payment is fixed, guaranteed for Self, Nominee, it would help in creating long term cash flow for self and dependent

- Limited premium payment options, from 5 years to 12 years

- Longest payout period from 25 years to 30 years

- Payout is fixed, guaranteed and tax free under Sec 10 10(D)

Entry Age : 05 to 60

Minimum Investment : 30,000 pa with no upper limit

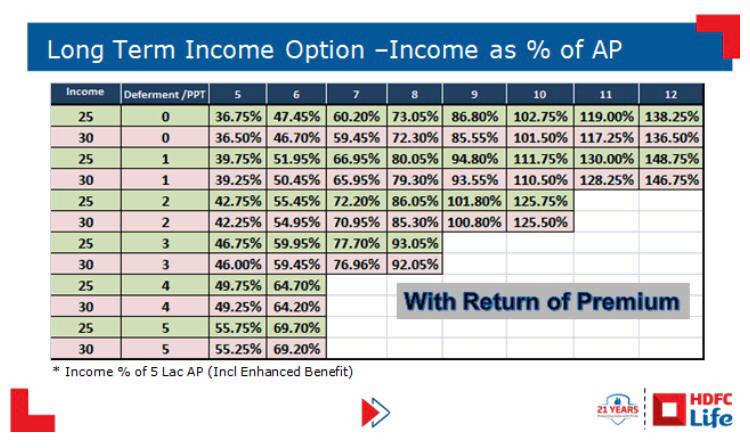

Sanchay plus payout chart :

Here you can choose different combination of premium payout and cooling period like pay Rs 1,00,000 for 5 years and choose cooling period from 0 years to 5 years get Rs 55,750pa for 25 years or Rs 55,250pa for 30 years + premium paid (Rs 5,00,000) upon maturity.